|

The following article was originally

published by Koinonia House in mid

to late 2010. I thought it a

very well written explanation of

where we have come from, and where

we have arrived at in our current

finacial condition as a country and

as a world.

The question

is,"Where Are We Going?" I

dont't know that.....I only know

that it doesn't look very promising

at the moment.

The only

thing I can be sure of is that God

is in control.....and He knows

exactly where we will end up.

Commodity

Money and Fiat Money:

A Bushel of Wheat for a Penny

by Steve Elwart

|

|

This is Part 1 of a three-part series on

money: where it comes from, how governments

use it to control our lives, and how modern

money policy makes the prophecies in the

Book of Revelation seem very close to

fulfillment.

Everyone reading this article is being

robbed. We all use paper money and every

day, governments are lowering its value.

That value is being stolen from us. To

understand how this is happening, we need to

get to the basics of money. What is it?

Commodity Money

We learn in Genesis that Abram (renamed

later by God to Abraham) was a rich man. How

do we know? We are told that “he had

sheep, and oxen, and he asses, and

menservants, and maidservants, and she

asses, and camels.”1 In

Biblical times, these things were all media

of exchange. No king decided this; he didn’t

call in his magi to decide what the medium

of ex-change would be. Ordinary people, or

“the market” made the decision. Let’s say a

king did decree that rocks could be used as

money. Would anyone use them? Probably not,

because they would not know the value of

those rocks. Unless you are building a lot

of things (or stoning a lot of adulterers),

rocks fail to meet a standard for money:

they have no intrinsic value.

If a civilization was to advance though, it

had to come up with a convenient way to save

and exchange value to buy things. Leather

was used in ancient Rome. (Contrary to

popular belief, Roman soldiers were not paid

in salt. The term salary [from the Latin

salārium] was money given to Roman

soldiers to buy salt.2) Animal

pelts, whiskey, and tobacco leaves were used

in the former British Colonies, wampum

(strings of beads) was used by the American

Indians, dried fish were used in the

Canadian maritime colonies, maize or corn

was used in Mexico, and salt, iron and

farming tools were used in Africa. These

things are called “commodity money.” As

civilizations became more complex, most

forms of commodity money be-came very

cumbersome. (Who would want to give or get

300 sheep to buy a car?) Another medium of

exchange had to be found.

Over the centuries, the answer came to be

the precious metals, gold and silver. These

two metals became the basis for money in

most of the world. Gold and silver were used

as money for very specific reasons and they

were chosen by “the market.” People decided

that these two metals had all the qualities

that made for a good medium of exchange:

• They were easily portable. They had high

value to weight ratios. (So if you want to

buy a car, you only have to bring 16 ounces

of gold rather than 300 sheep.)

• They are fungible. Every ounce is like

every other ounce no matter where they were

mined. People didn’t have to worry about the

quality of the pure metal.

• They are highly divisible. They can be

divided into very small parts or coins. The

term “pieces of eight” came from the

practice of taking a Spanish dollar, a real

de a ocho and breaking it up into eight

pieces or reales to make change. Diamonds

fail the test of being divisible because if

you break up a gem-quality diamond, it loses

its value. (For that matter, sheep aren’t

easily divisible either unless you are very

hungry.)

• They are highly durable; the thirty pieces

of silver paid to Judas are still in

existence today.

• They are naturally scarce. They can’t be

multiplied.

Fiat Money

There is another type of money besides

commodity money, called fiat money. (Fiat

from the Latin fiat, meaning “let it

be done.”) This is an item, usually paper or

low value metal coins, that is decreed to

have value by a government.

A government puts fiat money into

circulation first by connecting it to a gold

or silver standard, but then cuts the link

and says that gold and paper are no longer

convertible, making the piece of paper

“legal tender for all debts public and

private.” It is obvious that debtors would

be very happy if the pa-per money lost its

value because they could pay their debts

with inflated currency. In a letter to

Edward Carrington in 1788, Thomas Jefferson

wrote, “Paper is poverty … it is only the

ghost of money, and not money itself.”

Jefferson died bankrupt because of the early

United States money (monetary) pol-icy based

on paper.

It is not that fiat currency is a new

invention. Fiat currency actually made its

appearance over 1,000 years ago. China was

the first country to issue true paper money

around the 10th century A.D. Although the

notes were valued at a certain ex-change

rate for gold, silver, or silk, conversion

was never allowed in practice. The bills

were supposed to be redeemed after three

years in circulation, but as more bills were

printed with the older notes being refused

redemption, inflation became evident.

Government measures to prop up the currency

were unsuccessful and it fell out of favor.3

In Europe, fiat money came into being around

the 12th century. Villagers would store

their gold and other valuables in their

lord’s castle for safekeeping. But during

this time of the Crusades and other European

Wars, noblemen were always strapped for

cash. When times were particularly bad, the

noblemen would confiscate the villagers’

gold and silver and issue notes for it, to

be redeemed later. Needless to say, the

notes weren’t always honored or if they were

redeemed, the holder of the note received

less of their gold back than what they were

promised. This is an early case of price

inflation.

Today, fiat money will always bring on

inflation for two reasons: 1) Politicians

like to induce inflation because it gives

the people the illusion of prosperity and 2)

its declared value is much higher than the

cost of producing it. Whether it is a $1 or

$100 bill in fiat money, it costs only 4

cents to produce. In today’s electronic age,

the production cost for new money is zero

since money creation is just a keystroke and

an entry in cyber-space. On the other hand,

in history, if you had a $20 gold piece, the

cost of that gold piece, less the cost to

produce it, was about $20.

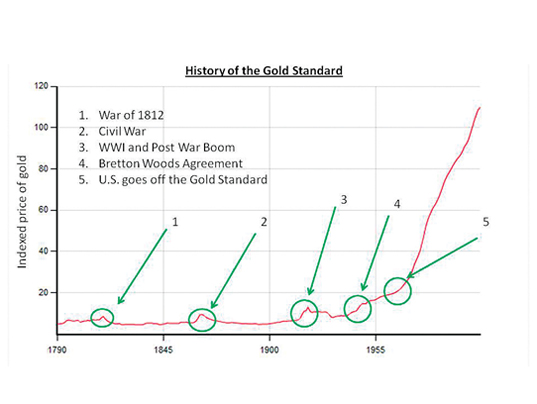

The Gold Standard

If

the relative value of gold is tracked over

the years, one can see how fiat money loses

its value over time.

By the 1400s, most countries that had

complex trading systems were using gold and

silver for transactions. Prices held

relatively steady through the early 20th

century, except for lo-cal shortages and

wars. In the United States the price of gold

and the things it bought held its value with

exceptions for war-time when the government

printed paper money to cover its war debts.

After the emergencies and the country went

back on the gold standard, prices went back

to about where they were. During the First

World War, most countries involved in the

war suspended the gold standard so they

could print enough money to pay for their

involvement in the war. After the war, these

countries went back to a modified form of

the gold standard, but abandoned it during

the “Great Depression.”

In 1941, most countries adopted the Bretton

Woods system, which set the exchange value

for all currencies in terms of gold.

Countries that signed the Bretton Woods

agreement were obligated to convert their

currencies held by foreign countries into

gold valued at $35 per ounce. However, many

countries just pegged their currency to the

U.S. dollar, thus making it the de facto

world currency.

In the 1960s the United States had done

something unprecedented in its history. The

country fought two wars at once. The United

States fought a war halfway around the world

in Vietnam and a second war at home, the

“War on Poverty.” To do this, the United

States started to borrow massively and

brought on double digit inflation. To curb

the inflation, the United States government

started to deflate the dollar. 1963 marked

the entrance of the new Federal Reserve

notes and the disappearance of the $1 silver

certificate. This marked the point that no

longer did the U.S. Government have to pay

in “lawful money.” Finally, in late 1973,

the U.S. government decoupled the value of

the dollar from gold altogether and the

price shot up to $120 per ounce in the free

market.4 Since the United States

went off the Gold Standard, a dollar is

worth only one-sixth of what it was in 1973.

(At this writing, gold is priced at $1,220

per ounce.5)

Inflation Always Follows Fiat Money

The history of price inflation in the United

States is repeated in every country that

uses paper money. Keep in mind, rising

prices are not always bad. If a good becomes

scarce, its price will go up and may provide

the motivation to introduce a new, better

product for the market. The reason petroleum

became so popular so quickly was because of

the rising cost of whale oil. If governments

propped up the price of whale oil to keep

whalers and whale oil processors employed,

it would have taken decades for the world to

embrace petroleum as a substitute. And

someday, petroleum will go the way of whale

oil as long as market forces dictate the

transition.

When a government inflates its currency, it

increases prices by reducing the purchasing

power of the money. The short-term effects

though, can seem to be positive. Like a drug

addict, inflated money gives the illusion of

prosperity, making people feel good. But

like the addict, withdrawal follows the

high.

At first, the surge of more money makes

people feel good be-cause they can pay off

their debts with cheaper money and they seem

to have more disposable income. As prices

catch up, people then find it more expensive

to live. In addition, their tax burden goes

up, since many government taxes are

progressive in nature, meaning the

percentage tax increases as in-come or asset

values (houses, cars, etc.) increase.

Eventually the market will try to correct

itself and a depression will follow.

At this point, people start to feel the

pinch of their money buying less. They

demand that their government do some-thing.

Since studies have shown that voters only

have a memory of one year when it comes to

politics, politicians will make sure that

the economy is good in an election year.6

They will artificially stimulate the economy

to give voters the illusion that times are

good again and reelect the incumbents. This

lasts only so long and inflation, with its

problems kick in again. This cycle of

increasing the currency supply and price

inflation ultimately ends with the collapse

of the currency, sometimes preceded by

hyperinflation. (Hyperinflation and its

cultural effects will be covered in Part 3

of this series.) Surprisingly, the country

has not learned its lesson and the devalued

fiat currency is replaced with yet another

fiat currency. Greece is a perfect example

of this cycle.

The Greek drachma was minted in gold and

silver in ancient Greece and made its

reappearance as a fiat currency in 1841.

Since then, the value of the drachma

decreased. During the German-Italian

occupation of the country from 1941-1944,

hyperinflation ravaged the country, ending

with the issuance of 100,000,000,000 (100

billion)-drachma notes in 1944. After Greece

was liberated from Germany, old drachmae

were ex-changed for new ones at the rate of

50,000,000,000 to 1. Only paper money was

issued, again a fiat currency. Greece then

went on a program of deficit spending for

social programs and inflation started once

again.

In 1953, in an effort to halt inflation,

Greece joined the Bretton Woods system and

the drachma was revalued at a rate of 1000

old drachma to one new drachma. In 1973 the

Bretton Woods System was abolished; over the

next 25 years the official exchange rate

gradually declined, from 30 drachmas to one

U.S. dollar to a ratio of 400:1. On January

1, 2002, the Greek drachma was officially

replaced as the circulating currency by the

Euro (again a fiat currency).7

Today, Greece is once again is in trouble.

After years of continued deficit spending

and the government’s easy monetary policy,

Greece’s financial situation was badly

exposed when the global economic downturn

struck. Very quickly, the government’s

“creative accounting” practices were

exposed. The national debt, put at €300

billion ($413.6 billion), is bigger than the

country’s entire economy, with some

estimates placing it at 120 percent of gross

domestic product in 2010. The country’s

deficit—how much more it spends than it

takes in—is 12.7 percent.

This time though, Greece just can’t inflate

their way out of the problem. Now that they

are on the Euro (in the “Euro-zone”), they

have little control over their monetary

policy. All their loans are in Euros and

they must pay back the loans in Euros. One

way to balance the national books is to

implement harsh and unpopular spending cuts.

Another way is to default on their debt.

This would seriously damage the Euro as

other countries look at default as a way out

of their financial problems. (In fact,

financial experts are predicting the demise

of the Euro in as early as five years.8) A

third way out is to separate itself from the

Euro, go back on the drachma (fiat currency

again) and then set an exchange rate of the

drachma to the Euro at an artificially high

number. The cycle of fiat money would then

begin again.

As long as a country is on a fiat currency,

inflation is sure to follow. Using a fiat

currency could well reduce a civilization to

work an entire day for a “bushel of wheat.”

In Part 2 of this series we will look at

central banking and how the banks can change

a society.

**NOTES**

1. Genesis 12:16b

(KJV).

2. “The American

Heritage Dictionary of the English Language,

4th edition”. Answers.com. Retrieved 2010

3. Ramsden, Dave

(2004). “A Very Short History of Chinese

Paper Money.” James J. Puplava Financial

Sense.

4. History of the

Gold Standard:

http://useconomy.about.com/od/monetarypolicy/p/gold_history.htm

5.

Monex Precious Metals:

http://www.monex.com/monex/controller?pageid=prices.

6. “Voters Respond

to Economic Woes” Economics and Public

Policy:

http://knowledge.wpcarey.asu.edu/article.cfm?articleid=1668.

7. Greek Drachma,

Wikipedia:

http://en.wikipedia.org/wiki/Greek_drachma#First_modern_drachma.

8.

“Euro ‘will be dead in five years’”:

http://www.telegraphic.com.uk/finance/financetopics/budget/7806065?Euro-will-be-dead-in-five-years.html

|

A Bushel of Wheat for a Penny: Part

2

The Rise of the Central Banks

|

|

Last month we covered the two basic types of

money: commodity money and fiat money.

Commodity money, such as gold and silver,

are based on something tangible and has

intrinsic value. Fiat money, such as paper

money, is based on whatever a government

says it is worth. Commodity money keeps its

value for years and is stable. Fiat money

loses value from the time it is printed and

eventually becomes worthless.

Though not as long-lived as commodity money,

fiat money nevertheless has a long history

as well. As mentioned in Part 1 of this

series, villagers used to keep their gold

and other valuables in the lord’s castle for

safekeeping. Periodically, when the lord was

short of cash, he would “borrow” the

village’s gold and give them an IOU or

“script” in return. This paper money could

be returned at a later time, frequently for

less gold than was taken from them.

To avoid this problem, villagers started to

give their gold to the local goldsmith and

get a receipt in return. These receipts were

then used as money to buy and sell other

things. These gold notes could ultimately be

redeemed minus a small handling fee.

However, goldsmiths soon learned that not

all the gold would be redeemed at the same

time and started to make up receipts for

non-existent gold that he could use to

purchase other items. This was the start of

what is called “fractional banking.”

It was the Knights Templar that ran the best

known medieval central banking system.1

The Knights ran an innovative system that

utilized the first form of bank checks.

Pilgrims going to the Holy Land were always

in danger of being robbed on their way to

Jerusalem. To make themselves less of a

tar-get, pilgrims would deposit their money

with the Knights at the start of their

journey. They would then be given a coded

piece of paper that only the Knights Templar

could decode. When they reached their

destination, they would turn in their

“check” and be given the value of the check,

minus a handling fee. The Knights Templar

developed a network throughout Europe and

the Middle East and soon became the

wealthiest group in the Western World.

Eventually, their wealth became an

attractive target to the Pope and kings

indebted to them. The Knights were arrested,

their property confiscated and the Order was

disbanded. The Order may have disappeared,

but the financial system they left behind

survives to this day.

After

the Knights Templar, there were other

organizations that functioned After

the Knights Templar, there were other

organizations that functioned

as banks, but in 1609 the Bank of Amsterdam

was formed as the first central

bank. Later,

the Bank of Sweden was formed (1664),

followed by the Bank

of England (1694), with

both institutions still operating today.

While most

central banks are associated with

fiat money, these three banks and the

other

central banks formed through the early

twentieth century operated on the gold

standard. Since they were on the gold

standard, the currencies were stable and

inflation was kept under control.

In the United States, early banking was

carried on by the individual colonies and

operated on the gold standard, but the

economic pressures brought on by the

Revolutionary War caused the colonies to

start printing paper money to cover the

costs of the war. The Continental Congress

also started printing paper money, known as

Continental Currency, to cover its costs.

Both the state and continental currencies

depreciated rapidly, becoming practically

worthless by the end of the war. The term

“Not worth a Continental,” meaning something

of little of no value, came from this

period.

In 1790, at the end of the Revolutionary

War, Alexander Hamilton was the Secretary of

the Treasury and Thomas Jefferson was

Secretary of State. Hamilton wanted a strong

central government bank; Jefferson was

opposed to it. At the same time, Jefferson

wanted the nation’s capital to be on the

banks of the Potomac River in Virginia,

which Hamilton op-posed. So, a deal was

struck. In return for Hamilton’s support in

moving the capital from New York to the new

District of Columbia (Washington, DC),

Jefferson would not oppose the new federal

government assuming the war debts of the

former colonies and the founding of a

central bank. Thus, the First National Bank

of the United States was formed.

This bank didn’t last long. The charter for

the bank was allowed to lapse and was later

followed by the Second National Bank of the

United States. This was the bank that

President Andrew Jackson successfully shut

down. President Jackson thought that a

central bank had no right to create money

out of thin air. In his veto message,

Jackson wrote,

“Congress [has] established a mint to coin

money and passed laws to regulate the value

thereof. The money so coined, with its value so regulated, and such foreign coins as

Congress may adopt are the only currency

known to the Constitution.”2

It was the Panic of 1907 that served as the

reason to create the third central bank,

called The Federal Reserve in 1913. (This

bank is neither a “federal” institution, nor

a “reserve” for gold.)

Other central banks soon followed: Australia

established its first central bank in 1920,

Colombia in 1923, Mexico and Chile in 1925

and Canada and New Zea-land in the aftermath

of their Great Depression in 1934.3

Printing money wasn’t restricted to just

countries. One barrio on the outskirts of

Caracas, Venezuela has created a “popular

bank” and is going to issue a “communal

currency”; currency printed on “little

pieces of cardboard.”4

The Federal Reserve began a course of

inflationary policies by printing paper

money that was not backed by gold but

nonetheless promised to be redeemed for

gold. In 1933, during the administration of

Franklin Delano Roosevelt, it became illegal

for U.S. citizens to own more than $100 in

gold coins or bullion ($1,660 in today’s

dollars), thus making the dollar bills

irredeemable for gold in the United States,

but not for overseas investors.5

On August 15, 1971, President Richard Nixon

officially took the U.S. off the gold

standard.6 From then on, U.S.

currency has been backed by the “full faith

and credit of the United States Government.”

This didn’t seem to be a problem for the

bankers and lenders of the world. The U.S.

dollar was the de facto currency standard

for the world. All major transactions done

around the world was based on the dollar.

“Sound as a dollar” was used as a popular

expression for something of quality.

What happens though when people have little

faith in a currency and the country has no

credit? The United States is about to find

out. The United States has run a budget

deficit every year, except for a four-year

period during the Clinton and G.W. Bush

administrations, since 1968.7 The

total federal debt this year will exceed the

total gross domestic product of the entire

country.8 Over 18% of all

government payments will go to interest on

the debt.9

The states of California, Illinois,

Michigan, and New York are all close to

defaulting on their obligations and are

looking to the federal government to bail

them out. The price of gold is at an

all-time high and people continue to buy

gold no matter how much it costs. Moody’s

Investor Service has warned that if the

situation doesn’t change, the United States

will lose it AAA credit rating.10

The “faith and credit” of the United States

is shaky at best.

Normally, when a country expands its money

supply, it will offer bonds to other

countries. The lending countries will buy

the bonds and then the borrowing country

will use that money to issue paper currency

to the lending banks at a set interest rate.

The problem many countries have now is that

lending countries are not buying. This puts

the borrowing country in a bind. Since

slowing the rate of increase of the money

supply will invite a recession (a way for

the economy to readjust itself back to

reality), politicians will want to “boost”

the economy by increasing the money supply.

With no one buying a country’s debts, the

debtor country is reduced to printing money

that is backed by nothing. This is called

“monetizing the debt.”

Ben Bernanke, the chairman of the United

State’s central bank, the Federal Reserve,

has been accused of gearing up the printing

presses. Of course, in these days of

electronic funds transfers (EFT), a printing

press isn’t even required. A simple computer

entry into a balance sheet will suffice.

In the last two years, the United States has

put $2.5 trillion into the world’s

economy.11 Continuing to expand

the money supply in such a manner could

cause a hyperinflation only seen in recent

history in developing nations and post-World

War II Germany. (We will visit the topic of

hyperinflation and its effects on society in

the third and final section of this series.)

Monetizing the debt does have a short-term

advantage in the opinion of those who favor

manipulating the money supply to regulate an

economy, the so-called “Keynesians”12;

you can set an interest rate to be whatever

you want it to be.

When the Federal Reserve lends money to the

member banks, the lending interest rate is

at least equal the borrowing rate, plus

additional percentage points to account for

inflation and profit. If you monetize the

debt, you don’t even have to charge

interest.

That is where the United States is now. The

Federal Re-serve is lending money to banks

at 0% interest. Some economists ask, “What

does that even mean”? Lending money at 0%

interest in an economy with an inflation

rate of 2.3% means the borrowing banks are

actually being paid to take the money. Some

economists feel that this is the best way to

“stimulate” the economy. Others feel this is

a terrible idea.

The “housing bubble” that the United States

experienced over the last few years is an

example of what happens when the money

supply is increased. While the problem in

housing started in the late 1970s with the

Community Reinvestment Act in the Carter

Administration,13 the problem

went into overdrive in the last few years.

When housing prices in major metropolitan

areas began to “soften” (read that “return

to a realistic level”), the Federal Reserve

increased the money sup-ply by lowering the

interest it was charging for its money. This

in turn lowered the interest rate offered to

home owners, often to people who could not

afford to buy the homes. These people were

told that they could actually afford these

homes, by “creative financing.”

People were offered short term (3-5 year)

loans with low interest rates and payments

not even covering the monthly interest. The

thinking was that when these loans came due,

the equity in their homes would increase

enough that they would be able to get

another mortgage and catch up on their

payments, because the increased value of

their home would help pay down the original

loan balance.

Others used their homes as a personal piggy

bank, taking out second mortgages to buy

consumer goods such as a second home, a car,

a boat or to pay off credit card debt. This

frenzy in the housing market would not have

occurred had the monthly payments bore some

semblance to reality. Once the housing

market was saturated, home prices became

stagnant and then began to fall as demand

began to fall. Home owners found themselves

in “upside-down” mortgages where they owed

more money on the house than it was worth.

Many people then did what they thought was

the only rational thing—they walked away

from their mortgages. Mortgage holders

(usually investment funds used for

retirement savings, etc.) quickly found out

that the AAA bonds they held, backed by home

mortgages, were nothing more than junk

bonds. The monetary policy of the central

bank, put in place for political purposes,

was a house of cards that started to

collapse.

That house is still collapsing today. The

credit collapse in the United States caused

a ripple effect around the world. We are

seeing the effects in Europe with the

bailout of Greece (and possibly Portugal,

Italy and Spain), the austerity programs in

Britain and Ireland, and the calls from

China, Russia, and others to move away from

the U.S. dollar as the world’s re-serve

currency. This last event could have

devastating consequences.

The politicians in Washington, of both

parties, don’t seem to realize just how

serious the problem is as they are

continuing to spend money they don’t have.

They are continuing to say the only cure for

an economy sick from borrowing too much

money is to borrow more. This was the same

thinking that brought disastrous

consequences to Germany in the 1920s and

ultimately to the entire world.

In the third and final part of this series,

hyperinflation and its effects on a culture

will be investigated.

**NOTES**

1. Sanello, Frank

(2003). The Knights Templars: God’s

Warriors, the Devil’s Bankers. Taylor

Trade Publishing. pp. 207–208.

2. “President

Jackson’s Veto Message Regarding the Bank of

the United States; July 10, 1832,”

http://avalon.law.yale.edu/19th_century/ajveto01.asp.

3.

http://en.wikipedia.org/wiki/Central_bank.

4. Venezuela slum

takes socialism beyond Chavez,

http://www.alertnet.org/thenews/newsdesk/N04171136.htm.

5. Executive Order

6102,

http://www.presidencey.ucsb.edu/ws/index.php?pid=14611.

6. It is an

interesting sidenote that a country cannot

be a part of the IMF (International Monetary

Fund) if its currency is on the gold

standard.

7.

http://www.coneofsilence.info/img/blogs/deficit(7-11-07).gif.

8.

http://shadowstats.com/article/issue-number-50-overview.

9. GAO Audit Report

2007-2008 Schedules of Public Debt.

10. Moody’s Says U.S. Debt Could

Test Triple-A Rating,

http://www.nytimes.com/2010/03/16/business/global/16rating.html.

11.

http://www.marketskeptics.com/2009/03/fed-is-planning-15-fold-increase-in-us.html.

12. Keynesian economics was

purposed by 20th century British economist

John Maynard Keynes (1883 – 1946).

13. Avery, Robert B.; Raphael W.

Bostic, Glenn B. Canner (November

2000). Lending.” Economic Commentary.

Federal Reserve Bank of Cleveland. Retrieved

2010-07-05.

|

|

|

A Bushel of Wheat

for a Penny: Part 3

Hyperinflation and

its Effect on

Cultures

|

|

In part one of this series,

we covered the difference

between fiat and commodity

money. As countries moved

toward a fiat currency, the

money supply increased and

started to lose value. Part

two of the series explored

the rise of the central

banks. It covered how

central banks came into

being and how they

contributed to the

destruction of a nation’s

currency by creating a false

business boom, then the

final economic collapse.

This article, the third and

last of the series, will

cover the endgame of an

irresponsible fiscal policy,

hyperinflation. Economist

Ludwig von Mises warned us

in 1912:

The [business] boom produces

impoverishment. But still

more disastrous are its

moral ravages. It makes

people despondent and

dispirited. The more

optimistic they were under

the illusory prosperity of

the boom, the greater is

their despair and their

feeling of frustration. The

individual is always ready

to ascribe his good luck to

his own efficiency and to

take it as a well-deserved

reward for his talent,

application, and probity.

But reverses of fortune he

always charges to other

people, and most of all to

the absurdity of social and

political institutions. He

does not blame the

authorities for having

fostered the boom. He

reviles them for the

inevitable collapse. In the

opinion of the public, more

inflation and more credit

expansion are the only

remedy against the evils

which inflation and credit

expansion have brought

about.1

Mises is warning us about

the same thing that the Holy

Spirit through Paul cautions

of in the Book of Romans. In

Romans, Paul writes of the

importance of a man’s faith,

rather than his works. When

man takes the center of his

being away from God, he

tends to attribute his

success to his own efforts

and his failures to others.

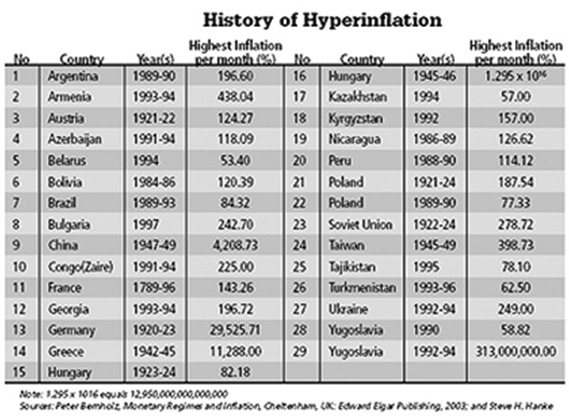

So, what happens to a

society when the ravages of

hyperinflation start to

consume an economy? What

happens when the money dies?

Hyperinflation in a country

is more common than we

think. Israel went through a

period of inflation in the

1970s and ’80s.2

Prices in Israel went from a

13% increase in 1971 to 445%

in 1984. People would hoard

phone tokens since their

value would not change as

prices rose. At the time,

there was a joke going

around that it was better to

take a taxi from Tel Aviv to

Jerusalem rather than a bus

because you could pay the

cab fare at the end of the

trip when the shekel was

worth less.

A major contributor to

inflation was the government

expanding the money supply.

The Israeli government tried

to automatically raise wages

as the inflation rate went

up. This move was meant to

keep the people from feeling

the effects of inflation,

since their incomes rose

with their expenses, but

indexing just added to an

inflationary spiral. As the

chart above shows, while

Israeli inflation was bad,

other countries have

experienced much, much

worse.

Money has several

characteristics. Its value

is stable, it has a high

value per unit (meaning you

should not have to bring

wheelbarrows full of money

to the store to buy things),

and it is durable; it lasts

over time. You try to

acquire it because you know

it will be useful in the

future.

That brings us back to the

question, what happens in a

society where this is no

longer true? A society that

does not have a strong faith

in God has the lives of

their citizens turned

up-side-down. A person

without God in their life

will call their entire value

system into question. The

facts represented in the

chart, however, demonstrate

that in the last century,

many societies fell into the

trap of inflating their

currency.

From previous experience,

these societies should have

learned that inflation is

folly, yet they kept doing

it. The reason is that

inflation is not just an end

in itself; it serves

ideological goals as well.

Goals like expanding the

State, favoring debtors over

creditors, and funding wars.

Governments actually favor

inflation and the social

upheaval it causes.

Ben Bernanke, the Chairman

of the United States Federal

Reserve, said in a speech,

“…the U.S. government has a

technology, called a

printing press, that allows

it to produce as many U.S.

dollars as it wishes at

essentially no cost. By

in-creasing the number of

U.S. dollars in circulation,

or even by credibly

threatening to do so, the

U.S. government can also

reduce the value of a dollar

in terms of goods and

services, which is

equivalent to raising the

prices in dollars of those

goods and services. We

conclude that, under a

paper-money system, a

determined government can

always generate higher

spending and hence positive

inflation. 3

At first the effects of

inflation are masked to us.

Sometimes you have to think

about it. For example, oil

prices went up because of

the inflation of the

benchmark U.S. dollar. As a

result, airlines’ fuel costs

went up. The airlines

started to charge more to

passengers. Not only did

they increase the ticket

price, but they also started

charging for bags. Now

airlines call maintenance

delays “Acts of God” so they

don’t have to pay for

overnight stays at hotels. A

delayed plane will keep

their passengers on the

plane for hours, rather than

go back to the gate and pay

an additional fee.

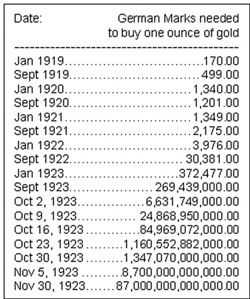

Post

World War I Germany (known

as the Weimer Republic)

serves as an example of what

happens to a country that is

going through

hyperinflation. Post

World War I Germany (known

as the Weimer Republic)

serves as an example of what

happens to a country that is

going through

hyperinflation.

Germany used inflation to

pay reparations, abolish

their national debt and

build up the regime. Just as

today, the effects of this

monetary policy were not

obvious at first.

In 1918, the inflation rate

in Germany ranged from 1% to

6%, lower than many other

countries in Europe. By

1923, the Deutschmark had

fallen to

1/1,000,000,000,000

(one-trillionth) of its

value from the previous five

years. Bank policy had not

changed too much, but the

German people began to lose

faith in their money and

began to act differently.

It

was like a forest fire that

raged out of control. The

entire society went into

upheaval because the money

died.4

At the time, no one really

understood that it was the

Central Bank that was

causing the problem. Foreign

exchange problems were

blamed as well as other

things like the weather (as

is being blamed in Zimbabwe

now), but above all,

speculators. Speculators

were at the top of the list

of evildoers. The Central

Bank was seen as the main

problem only in retrospect.

After the hyperinflation

started in Germany, the

National Socialist Party

(Nazis) took power. There

was a connection between the

two. Bernd Widdig, the

author of the book

Culture and Inflation in

Weimar Germany, had an

interesting theory. He said

that money helps shape our

values and what we do. When

the money dies, what do you

turn do?

The argument of the National

Socialists was: “Your money

has failed you, the

speculators and the money

lenders (as they described

the Jews) have failed you.

You can’t depend on

capitalism anymore. You need

something else, something

that is going to last. That

is Germany. That is what

lasts, not money, not

capitalism. You need order,

order rooted in blood.” The

German people accepted what

the Nazis said only because

the money had failed. When

the money fails a society

starts to fall apart and

people will accept ideas

they never would have

accepted before.

There are other effects from

inflation as well.

It fosters the expansion of

government

– In the early 1960s,

cautioning that federal

spending had a way of

getting out of control,

United States Senator

Everett Dirksen observed, “A

billion here and a billion

there, and pretty soon

you’re talking real money.”5

Today, that statement is

almost laughable. In the

first year of the Obama

administration, over $1

trillion dollars (one

thousand billion) was added

to the United States

national debt. This set a

new record in spending,

surpassing the previous

record set by the George W.

Bush administration.

Politicians soon forget that

the rights of the government

come from the governed, not

the other way around. One

U.S. representative is

quoted as saying in a town

hall meeting, “The federal

government can do most

anything in this country.”

6

It gives politicians an

“unrestrained vision”

– Going hand in hand with

the expansion of government

is its “unrestrained

vision.” Recent

administrations thought they

could conduct two wars and

then have free healthcare

for everybody. Politicians

want to promote that an

education for everyone is a

“right.” They want to give

each child born a $5,000

trust. They say everyone

deserves their own home, and

at least one car along with

a myriad of other things.

When you have the printing

presses running 24 hours a

day, 7 days a week,

every-thing is possible.

It crushes charitable

institutions

– In the 1930s, in

preinflation Vienna, there

were huge non-profit

agencies with money to care

for widows, orphans and the

poor. Organizations that

would rival charities today.

These organizations were all

wiped out in the inflation.

These were the institutions

that stood between the

people and the Welfare

State. The uncertainty of

hyperinflation provides a

ready excuse for people not

to support charitable

institutions and they will

fall into decline.

It turns people against

capitalism

– This is a dangerous

aspect. Just as in Weimar

Germany, people blamed the

“greedy fat cats” for the

nation’s woes. In today’s

Greece there is a pent-up

resentment towards corporate

executives. They blame “the

bosses” for Greece’s

economic troubles rather

than the rampant government

spending. In the United

States, even though the

present tax code will hit

taxpayers at all levels, it

is being purported as only

affecting “the rich,” those

with annual incomes over

$250,000. The rationale is

that after a while, “you

have made enough money.”7

The administrations of

several western countries

are turning towards

socialism even as socialist

countries (i.e. Russia &

China) are lecturing them on

excessive government

spending and control.

It teaches people to live in

the present

– When the value of money

starts to rapidly decrease

in value, people tend to

live more “in the moment.”

There is no incentive to

save and to anticipate,

since it doesn’t pay to deny

yourself now for some

benefit later. Eventually,

those that practice “old

time” values of saving and

investing are seen as fools

and losers since any-thing

you have today won’t be

worth as much tomorrow.

These effects are especially

strong among the youth. They

learn to live in the present

and scorn those who try to

teach them “old-fashioned

morality and thrift.”

Inflation thereby encourages

a mentality of immediate

gratification that is

plainly at odds with

Biblical principles of

stewardship.8

It subsidizes debt and

addiction to credit

– When the value of money

decreases over time, it

doesn’t make sense to people

to save money for

everything. If you are going

to “live in the present,” it

seems reasonable to buy on

credit and pay the debt back

with cheaper money. People

become addicted to credit.

People will max out their

credit cards even as the

banks tighten down on

credit. Today, there is

actually an organization

called Debtors Anonymous, to

help people with credit

addition. Debtor-support

groups have sprung up around

the country to help combat

the problem.

The result is a rampant

materialism

– As people have to dwell

more on money and finances

because of inflation,

society becomes more

materialistic. More and more

people will trade their

spiritual well being and

family relationships for

more money to make ends

meet. People will work

longer than they planned

because their savings have

been wiped out. They may

have to take a job far away

from their home and family.

This inflation-induced

geographical mobility

weakens family bonds and

loyalty to their country.

People who take their eyes

off God and turn them toward

the things of this earth

fall prey to sin.9

The biggest danger here lies

in people’s focus turning

away from the things of God

towards the things of man.

The Book of Ecclesiastes

provides wise council about

money. “He that loveth

silver shall not be

satisfied with silver; nor

he that loveth abundance

with increase: this is also

vanity.”

While we need to be good

stewards of the material

goods the Lord provides us,

being too concerned about

the things of this world can

lead to a cancer in the soul

as James said.10 Throughout

these uncertain times, we

need to be mindful of the

things of God, rather than

the things of this world. If

we keep Christ in the center

of our lives, we will keep

our time here on earth in

perspective and better

weather the coming financial

storm.

**NOTES**

1. The

Moral Ravages of Inflation,

http://blog.mises.org/8289/the-moral-ravages-of-inflation/.

2. Senor,

Dan and Saul Singer.

Start-up Nation: The Story

of Israel’s Eco-nomic

Miracle. New York: Putnam,

2009.

3. Remarks

by Governor Ben S. Bernanke,

Before the National

Economists Club, Washington,

D.C., November 21, 2002,

www.federalreserve.gov/boardDocs/speeches/2002/20021121/default.htm.

4.

Hyperinflation: Money to

Burn,

http://millennium-notes.blogspot.com/2009/08/hyperinflation-money-to-burn.html.

5.

www.senate.gov/artandhistory/history/minute/Senator_Everett_Mckinley_Dirksen_Dies.htm.

6. Excerpt

from Congressman Pete

Stark’s Town Hall Meeting

7/24/2010, Hayward, CA,

www.breitbart.tv/congressman-at-town-hall-the-federal-government-can-do-most-anything-in-this-country/.

7. Obama:

You’ve Made Enough Money,

www.youtube.com/watch?v=k0JkyZx1LdQ.

8. The

Cultural & Spiritual Legacy

of Fiat Inflation,

http://mises.org/daily/1570#_ftn3.

9. Ibid.

10. James

5:3.

|

|

|